the price of [economic] freedom is eternal vigilance

Thomas Jefferson

3rd US President

16 March 2023, Grant Wilson

Thomas Jefferson

3rd US President

Since the news broke on Friday, we have been busy speaking with the myriad of managers we deal with on behalf of clients to ascertain the potential impact for clients.

We’ve been highly selective in our analysis and comments.

This is a complex and changing situation.

Background

Recently the US Banking system had its second largest bank failure in history, Silicon Valley Bank (SVB).

The government agencies, the US Treasury, the Federal Reserve and Federal Deposit Insurance Corp., created a liquidity backstop on Sunday, to prevent a run on other banks.

Banks can get into trouble in several ways. Banks tend to have a small amount of equity (owners’ capital) and lots of other people’s money (depositors). If they make losses on

investments, they can wipe out their equity quickly (become insolvent). If depositors lose confidence in the bank and ask for their cash back a bank might still be solvent but run out of liquidity.

The US government explicitly chose when implementing the Basel III accords to apply those rules, primarily relating to liquidity, only to “large, internationally active banks”. The strong and powerful community bank lobby managed to get themselves excluded from rules enforcing NSFR (Net Stable Funding Ratio) and LCR (Liquidity Coverage Ratio) the numerator of which is HQLA (High Quality Liquid Assets) – marked at the ‘right’ price.

What happened?

SVB, the 16th biggest bank in the US, was not subject to the bigger bank rules.

The enormous deposit growth over the last two years came from a relatively small number of big depositors in the technology sector.

When the private equity market slowed up his year some of these tech depositors started drawing on deposits rather than having follow on share offerings.

Technology firms generally pre-fund development costs as product cycle risks are significant and banks don’t generally lend to finance the creation of a new product (that is equity risk).

When SVB’s deposits were growing rapidly they invested in good quality bonds because they could not find sufficient loan demand among their narrow client base.

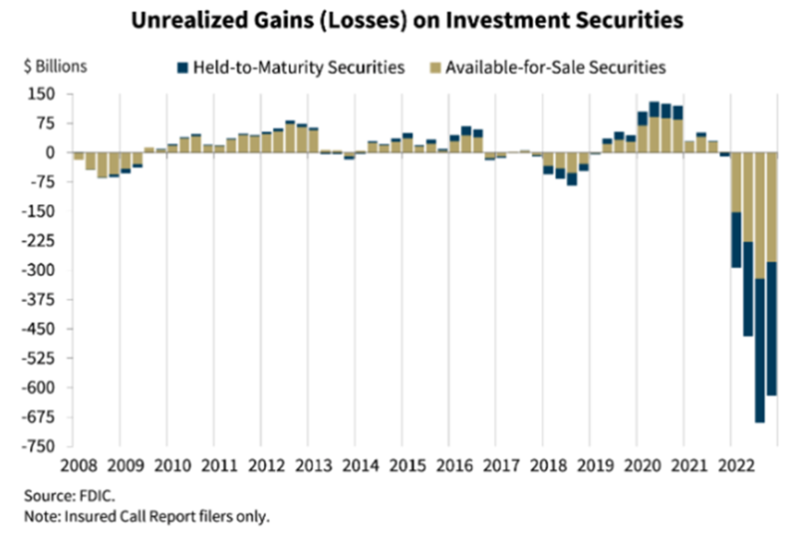

When interest rates rose rapidly SVB’s bond portfolio would have made significant losses if marked to market. If held to maturity these bonds would most likely return the principal and coupons expected, and this is how SVB accounted for their bond investments.

When depositors asked for their money back SVB was compelled to sell bonds and crystalise the mark to market loss. As the depositors saw the losses appear the run on the bank accelerated.

Fractional reserve banking can be risky. If you are depositing more than £85,000 in the UK or $250,000 in the USA and are therefore not “insured” you should give serious consideration to either short dated sovereign bonds or money market funds.

If you need help to find the right cash strategy for you, contact your friends at ARC.