News & Insights

ARC Research Commentary Review of 2022

05 January 2023, Graham Harrison

2022 A Year in Review

2022 has proved to be a challenging year for investors as a combination of factors including the war in Ukraine, inflation and slowing global growth triggered falls in the value of most asset classes over 2022.

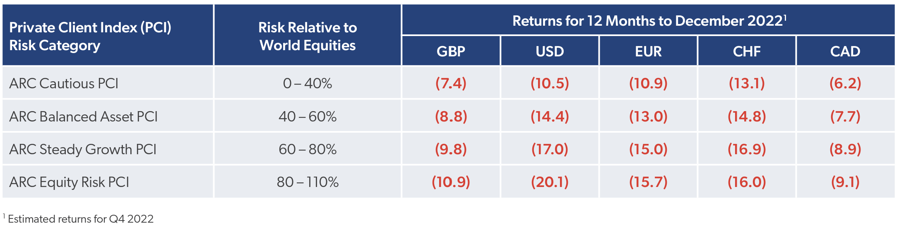

Thus, multi-asset class portfolios delivered negative returns for the vast majority of private client investors as the table below illustrates.

With falls in almost all asset classes, the notable exceptions being energy and commodities, there have been very few opportunities for investors to avoid losses. Indeed, sharp rises in government bond yields meant that traditional safe haven assets failed to provide capital protection.

Looking across the five PCI currencies, in local currency terms losses were highest for USD investors. However, that masks significant currency moves during 2022. For example, the US Dollar appreciated against most other currencies; versus Sterling it ended the year up 12% and at one stage was up 20%.

The Real Picture

So, how has the performance of a typical private client portfolio in 2022 compared to that experienced in previous years?

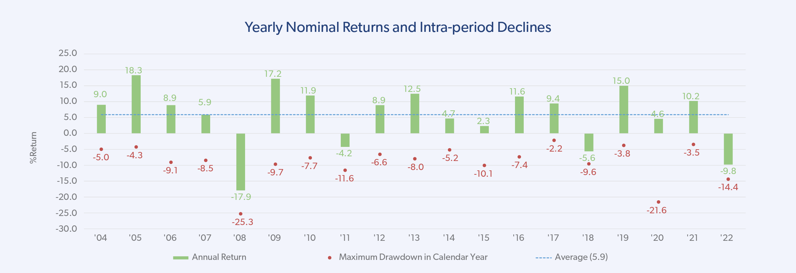

By way of illustration the chart below plots calendar year returns and maximum drawdown in each calendar year since 2004 using the daily estimated series for the ARC Sterling Steady Growth Private Client Index, the PCI series with the greatest number of constituents.

- UK inflation, as measured by CPI, is estimated to have been 10.7% for 2022, over four times higher than the average annual inflation figure from 2004 to 2021 of 2.3%.

- In real terms, purchasing power of the average Sterling Steady Growth portfolio declined by -18.5%, far closer in magnitude to those experienced in 2008 during the Global Financial Crisis.

- Real returns over the period from 2004 to 2021 for a Sterling Steady Growth investor averaged 4.4% per annum, roughly in line with longer term averages.

Extend the period to encompass 2022 and the annualised real return has been just 3.2% Looking to 2023 and beyond, it seems likely that investors will face ongoing uncertainty: a resolution to the conflict in Ukraine appears to be remote; geo-political tensions remain significant; slowing global economic growth may well turn into localized recessions; inflation may well prove stubborn as supply chain disruptions continue and labour shortages remain; and corporate earnings will surely come under severe pressure.

However, uncertainty also creates opportunities for discretionary managers and, with equity valuations becoming more attractive and real bond yields improving, there is hope that 2023 will be a better year for investors.

Speak to Graham about this article

A full list of Data Contributors to ARC PCI is available at www.suggestus.com

For those private client investors who wish to place their 2022 performance into peer group context, or indeed examine a longer period, the ARC Performance QuickCheck tool is a free, simple, independent analytical tool designed to perform a ‘health check’ on the performance of a discretionary portfolio.

Visit www.suggestus.com or search in your phone’s app store for Suggestus to get started.