News & Insights

ARC Wealth Indices Estimates

02 September 2025, Daniel Hurdley

August 2025 Estimates

August sees broad market gains led by tech and gold, despite dollar weakness

The rally in global equities continued during August, buoyed by hopes of an imminent U.S. rate cut and a continuation of the rally in large-cap technology stocks. Gains were broad based, with small-cap stocks outperforming large-cap and all global sectors rising with the exception of utilities. The S&P World Index delivered a total return of 2.74% in US dollar terms, ending just shy of the all-time high posted earlier in the month.

The US dollar gave back most of the ground gained in July, dropped circa. 2% against both the euro and the pound. US treasuries delivered positive returns, outperforming the government bonds of the UK and Europe which were broadly flat on the month. Gold had a good month, gaining 5% in US dollars.

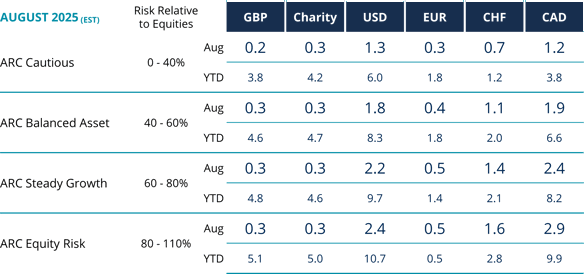

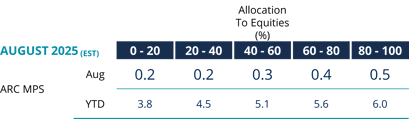

August is expected to have been another positive month for investors across the board. The US dollar and Canadian dollar PCIs will have generated returns between 1% and 3% depending on risk profile, while the sterling and euro indices will have lagged due to currency effects.